Articles

Finding the Hook to Strategy Implementation

“90% OF ORGANIZATIONS FAIL TO EXECUTE THEIR STRATEGIES SUCCESSFULLY.” Kaplan & Norton

A frightening statistic! Yet we have been trained that without a strategic plan a company is doomed for failure.

“STRATEGIC PLANNING AT A POINT IN TIME DOUBLES THE LIKELIHOOD OF SURVIVAL AS A CORPORATE ENTITY.” Noel Capon, James M. Hurlburt, Columbia University

So then, if companies can get the implementation right then the failure rate will go down and the survival rates will go up. Sounds like a plan (pardon the pun) but let’s really get to the root of the problem if we can.

I am sure you have heard of Murphy’s Law, Moore’s law and other similar laws which are based on relationships or concept translated through ratios. Well, here is one for you it’s called …

“Blanchard’s Law”, why not, and it relates to the key factors necessary for successful strategy implementation.

Here’s it is:

An organization’s success at strategy implementation =

The organization’s ability to effectively mobilize its resources and focus on strategy/ The organization’s ability to reduce the resistance in achieving buy-in and accountability

This means that the implementation of an organization’s business strategy (direction) is equal to the ability to mobilize the people, processes, systems and technology in an organization (power), divided by the organization’s ability to achieve buy-in, discipline and focus on the implementation of the strategic plan (resistance reduction).

What does this mean?

If an organization has the ability to actively mobilize all of its resources at 100 units and yet is held back by resistance to implementation by a factor of 10 units the resulting quotient or outcome is 10. In other words, if the level of resistance goes up the ability of the organization to implement strategy goes down. In this case, the organization is relegated to the lowest common denominator of strategy implementation of 10 units.

However, if the same 100 resource units faces a resistance factor of 2 the result is a 50 unit implementation factor. Thus, if the level of resistance goes down then the effectiveness of strategy implementation goes up.

The take away, reducing resistance is the key.

Simple huh, but why is it so difficult to address. I mean if an organization can reduce the level of resistance in the way it implements strategy the greater will be its productivity – why just do it.

The big question is how can this be done?

According to a study conducted by Canadian Society of Association Executives (CSAE), it determined there are clear patterns that emerge in successful strategy implementation efforts.

They observed three common-sense tests:

A. Manage to results milestones;

B. Explicitly addressed the people issues within the organization relative to strategy execution, and;

C. Resource properly, not just with money.

The CSAE also found that even the soundest strategies failed to achieve their performance objectives because one of these tests was flunked.

So getting all three tests right is important.

And getting them all right is a tall order if an organization relies on 20th century tools for implementation. How can an organization expect to win at strategy implementation using memos, presentations, occasional plenary workshops and performance compensation plans?

These are tools that can be a good start, but we are now in the 21st Century and powerful, integrative digital tools are now at our disposal. These tools can help to define outcomes, measure and then track strategy as it is implemented.

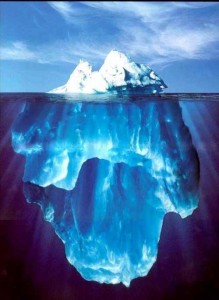

Using technology for strategy implementation is not just a one-time thing; but an integrative effort to instantly get at the underbelly of how strategy can be managed in an organization. Not only vertically and across an organization’s structure but to penetrate the very DNA of its culture as well.

I recently encountered a company called Envisio. They have spent the time and money to answer the 21st century call for a technology to help with strategy implementation. Envisio’s cloud based software can reduce the factors that create resistance holding an organization back. It gets at the very problems of implementation and allows for the revitalization of the strategic planning process as well.

Here are the key points in reducing resistance that makes the Envisio software so unique:

ACTIONABLE

Envisio provides a structured approach in creating and translating strategic plans into individual and team activities with measures. This way the organization can pinpoint resistance points and shore them up to improve implementation outcomes.

CLEAR

Everyone within the organization is assigned a role and responsibility to bring the strategic plan to life. It means that people become strategic thinkers making their contributions meaningful and accountable toward a common purpose. There is no room for ambiguity.

IN CONTEXT

Dashboards provide a view of individual activities and measurement that connect them to the plan. This allows the people in the organization to understand how they fit into the strategic plan and how they can reach strategic objectives.

DYNAMIC

Plan updates are automatically recorded and communicated to teams and individuals. Strategy implementation means all hands on deck working together in making things happen.

MANAGEABLE

Intuitive reporting revolutionizes management’s ability to track progress against the strategic plan and make adjustments when circumstances dictate. Remember there is no such thing as a perfect strategy so managing strategy under fire ensures management has its finger on the pulse.

I invite you to check out Envisio’s website to learn more about their technology and the unique opportunities it provides organizations. Envisio developed, markets and supports an easy-to-implement web-based strategy implementation software that flows from an organization’s strategic plan. I encourage you to visit – http://www.envisio.com/ for more information.

Lean Strategy Development – Moving from Attachment to Adaptation

“If you always do what you’ve always done, you’ll always get what you always got.” – James P. Lewis

“If you always do what you’ve always done, you’ll always get what you always got.” – James P. Lewis

Why do strategic planning? Is it really helpful to plan when things around us are changing so rapidly? Look at the current business environment that is changing as fast as quick change artists in a theatre show.

The rate of change as we have discovered is so fast that traditional planning horizons just can’t keep up and current planning techniques are obsolete. This means organizations are often caught with their pants down before they can realize on their previously planned outcomes.

So what has to shift in how organizations approach strategic planning? The answer –they must leave behind their attachment to traditional strategic planning approaches and move toward a lean and iterative strategic management process.

Here are five principles to help an organization create a strategic adaptation culture.

Focus on one goal at a time – Abridge

Focus is essential in any activity. Confusion results when there are too many directions undertaken at once.

For example, in the sport of football the single focus is to bring the ball into the end zone and score. Note I was very specific to indicate that it was not to score a touchdown because a field goal could very well be the way to score points as well. During a game the players focus on bringing the ball down the field concentrating on crossing the line of scrimmage consecutively. The goal is to reach the end zone and score – how it is done is a matter of tactics and team work.

For organizations the same is true. Having a clear and defined goal to focus on means that everyone in an organization will know what is expected of them and what is needed in getting the goal achieved. Keeping the goal simple and focussed allows organizations to create a rallying call for what ultimately matters strategically.

Build a culture that anticipates near term trends – Anticipate

Drawing again from sports, Wayne Gretsky once said, “I skate to where the puck is going to be, not where it has been.” This insight speaks to the element of anticipation. In the context of strategic implementation it means every person in the organization should be responsible for predicting future outcomes and brace for them. A strategy conscious organization should build a culture in which anticipation is encouraged and practiced regularly.

Empower employees to make decisions based on context – Adjudicate

It is virtually impossible for any executive or manager to make every decision in an organization. What is necessary is that employees be given the right and freedom to make decisions within the context of a single overarching goal. This means that they must have the ability to make decisions on the fly when changing circumstances dictate. This ability to adjudicate allows for a nimble and focussed organization that implements through the collective wisdom of its members.

Adjust and pivot in response to new circumstances – Adapt

The “Ready, aim, fire” business principle was changed in the ‘90’s to “aim, fire, aim, re-fire”. Why? Because it is always best to adjust to changing circumstances using a test and fine-tune mentality. If something isn’t working make changes to get it right and don’t stay long with a losing approach.

Tactics are stepping stones that provide the pathway to achieve the ultimate goal but also must take into account environmental dynamics to make adjustments. In business environments that are constantly changing, adaptation is essential in shaping a lean, iterative and adaptive plan for an organization to follow.

Constant motion toward the designated single goal -Activate

Finally, organizations are in a constant state of motion relative to their changing environments. Albert Einstein’s theory of relativity is, so to speak, relevant here. (Smile). He postulated that the faster an object is moving, the slower time progresses for that object in relation to a stationary observer. In other words keeping up with the changing environment requires an organization to be in constant motion – adjusting and adapting to fluctuating changes in order to keep on top of the things that are impacting its success.

Keeping in motion means an organization is learning and adjusting to decisions that are in many instances both wrong and right at any given point. Adjustments or deviations from the path are okay as long as the goal is being focused upon.

Is Crowdfunding Right for You?

One of the most successful Crowdfunding campaigns last year was the “Pebble” smartwatch Kickstarter campaign, which was launched on April 11th 2012. For those of you not familiar with the smartwatch, it wirelessly connects Android and iPhone smartphones to display email, calendar alerts, social media updates, run apps like GPS and, yes, it even tells the time.

Dick Tracey you gotta get this watch!

The “Pebble” reward based Crowdfunding campaign was an outstanding success. By May 18th 2012 the company raised $10.2 million from approximately 70,000 backers. Astonishingly $1 million was reeled in during the first 28 hours of the campaign and the rewards were various watch offerings which generated pre-sale orders of the watch proving market demand. The founder’s also used the campaign for product validation – testing colour choices and feature refinements.

Certainly Crowdfunding was right for Pebble and provided many benefits beyond the capital raised. However, how do you determine if reward-based Crowdfunding is right for you?

Here are some points for and against launching a Crowdfunding campaign that will help you decide if it makes sense for you and your company.

Pros

Access to Capital

Well this point is a no brainer; but there is more to it than just raising money. For those companies that cannot get funding from traditional sources such as banks or angel investors, Crowdfunding is a viable alternative – if, of course, the crowd sees merit in backing the project.

In addition as the relationship between backers and the company is through reward based incentives, in exchange for money, companies do not have to give up equity; therefore, there is a non-dilutive effect on share structures. This means you don’t have to give up equity in your company.

By having cash, start-ups can do more by way of risk reduction and in validating their ventures before they tap into subsequent equity or debt capital sources. This allows for a complementary pathway along the capital sourcing value chain.

Crowdfunding campaigns take less time than traditional fundraising activities. Generally a campaign is limited to a maximum of ninety days. Therefore, there are no protracted prospecting, pitching, due diligence and negotiation cycles which is often the case when dealing with banks, Angels or VCs, perhaps even family members for that matter. Companies can get their money faster.

Validates Your Company and Product

As the rewards usually are product based, there is ample opportunity to demonstrate whether the offering is attractive to a company’s target audience and, thus, providing traction through pre-sales. As with the Pebble example above, companies can use the process to infuse the customer’s voice into product design decisions. This feedback is worth its weight in gold, saving both time and money, in the product development process.

Establishes a Customer base

We know that getting the first customer is difficult; but when your customer base looks like a ground swell of evangelists that can take your project viral – your customers become your quasi sales force. Furthermore, entrepreneurs can get a rare insight into who is buying their offering and find out why the offering resonates with them. This permits entrepreneurs to create compelling tactics to expand their respective customer acquisition strategies. It also allows for experimentation by finding out what works and doesn’t work from a customer acquisition perspective.

Unique Marketing Channel

Crowdfunding forces the entrepreneur to be organized in his or her marketing activities by leveraging social media, public relations, a website presence, list creation, videos and the delivery of a multitude of passionate communications. It forces messaging to be clear, concise and easily understood by the target audience to get an immediate call for action. Marketing exposure is what it’s all about and we know that sometimes early stage companies are not very good at doing this.

Cons

It’s Sometimes All or Nothing

In planning a Crowdfunding campaign an entrepreneur must decide the fund raising goal – that is how much money to raise through the Crowdfunding campaign. This is an important step. Why? Because many CF platforms stipulate that the funds raised from your campaign are only released when 100% or more of the funding goal is reached. Therefore, in these circumstances, it is an “all or nothing” proposition. Although there isn’t a formal penalty for not reaching the funding goal, there is still the disappointment and the loss of time and effort which has to be considered.

In the next blog I’ll cover more on how to select a Crowdfunding platform because not all of them are the same and they vary with regard to this “all or nothing” policy along with other guidelines.

IP at Risk

Some argue that putting your Crowdfunding project on the Internet can expose a company to IP theft through the replication of the company’s concept or prototype design by a competitor. If your product is unique and this could threaten your company’s viability, then it is wise not to pursue Crowdfunding.

Yet, if this did happen, the crowd is able to see that your company was first with the idea and if a competitive brand comes to the market with a similar product the ill will this can create can backfire on a competitor. Of course, the best way to proceed is to register provisional patents, as a date and time stamp, before proceeding with a Crowdfunding campaign. This makes good sense in any event.

Sometimes by putting a Crowdfunding project out there, companies can establish interesting relationships with people or partners which would not have been possible otherwise. Opportunities can surface through serendipity with a little bit of boldness.

Not Right for Business to Business Products

By reviewing a litany of Crowdfunding projects featured on numerous CF platforms, it is clear to me that those projects that successfully receive funds are predominately those in business to consumer oriented sectors rather than business to business sectors.

Remember we are leveraging the benefits of the Crowd. And, Crowds represent a collection of individuals acting from their own personal belief systems and self-interests. They give to a Crowdfunding campaign because they might think it is cool, meaningful, worthy or resonates with their passion. This is in opposition to a collection of like-minded businesses which may have conflicting corporate objectives and represent more depersonalized motivations.

Simple not complicated

A Crowdfunding project should be simple enough for consumers to understand and allow them to get behind the Crowdfunding project. Complicated or overly technical projects can be difficult for a lay person to understand leaving them on the side line scratching their heads looking for a reason to support or back a project.

Large Capital Needs

Pebble scored big with their Crowdfunding campaign. However, this bonanza is not the norm for the majority of campaigns. Crowdfunding is ideal for seed capital rounds and by that I mean where capital needs are not in the millions of dollars but more in the less than $100,000 range. If your business needs a lot of capital rethink your capital raising strategy and look to more traditional sources.

On the other hand, Crowdfunding could very well be used as part of an overall capital raise strategy as it is just one more arrow in an entrepreneur’s capital raising quiver.

Lengthy R&D Projects

If your business is in the type of sector where lengthy R&D cycles are the norm (i.e., years not months), Crowdfunding is not for you. Backers want to see venture results quickly and be a part of the success within a short timeframe.

Crowdfunding has specific rules of engagement. I’ll cover these in my next post entitled – “How Crowdfunding Works” For more information on Crowdfunding read my white paper which I wrote last September. You can download it for free at www.creekstoneconsulting.com

How can I determine if there is a market for my technology?

Leonardo da Vinci had lots of ideas, some of which were never realized until many centuries after his death. His era just didn’t have the capability of absorbing his inventions nor did he know how to exploit them. Da Vinci and the people of his time just lacked the knowledge to make them relevant.

A pity really because no one had an inkling how innovative his inventions were and how many years later they would confer such benefits to future generations.

Molto grazie, Leonardo!

There are lots of great ideas floating around. Some bad ideas and some really, really great ideas that for many reasons will never get into the hands or minds of customers.

Ideas are basically – a dime a dozen.

It’s not to say that every idea in the 12 pack is worthless, in fact some of them might be worth millions or billions of dollars. The cold reality is – if ideas cannot be implemented and show value then they are worthless. Good ideas need to be placed in the hands of users to make a difference; otherwise they will remain tragically unknown.

Over the years I have helped my clients answer this basic question – “How can I determine if there is a market for my technology?”

There are two broad types of entrepreneurs that come to me asking this question.

Entrepreneur Type 1 – Entrepreneurs with an existing technology and are looking for a market

This is the most common situation.

Case in point: A group of technologists come up with an idea and expend both time and money to develop a technology. After months of development and with technology solidly in hand, they open their lab door, peer out and wonder who might be eligible buyers for their invention.

Here’s an example, a team of entrepreneurs in the wireless sector have an idea to create a cool mobile application which they believe would solve a problem for market segment X. They develop the application build out resources and begin to talk to potential customers. Very quickly and disappointingly they realize no one wants to buy their technology.

These entrepreneurs represent a technology looking for a market. Somewhat problematic – since doing the homework after the fact gets complicated. Why? Because technologies developed in a vacuum rarely succeed.

Entrepreneur Type 2 – Entrepreneurs looking for a customer need or problem in a defined market sector

This is the least common situation.

Entrepreneurs decide to research a specific market to find an unresolved problem, find one and design a technology solution that will satisfy the market’s problem. These entrepreneurs spend time and money in assessing a market opportunity first, then identify and build a technology solution to solve the market segment’s problem(s).

These entrepreneurs may have market domain knowledge and technology expertise; but, they approach the market assessment process first without a predetermined technical bias. This puts the market place first and the technology second.

So back to the question: “How can I determine if there is a market for my technology?”

Let’s look first at this scenario: A small team of entrepreneurs decide to start another technology company after successfully selling their company to a larger competitor. They decide the thrill of building and selling a company is worth another shot. They set off looking for a market problem that would be the focus for their next company. Finding one, they design a product solution to resolve the problem. As the prototypes are being built they also test them in concert with lead customers in the market – to get the product right.

Answer 1: A Market Assessment Analysis

In the above example, the former activity is called a market assessment analysis which involves a high level scan of the marketplace and gradually narrowing it down to a targeted market segment candidate. Direct feedback from this candidate segment provides the team with further insights into the problems that need to be resolved and the possible solutions which should be designed for the target customer segment.

Answer 2: Market Validation

The latter analysis is called a market validation study. At this point the solution is being tested with customer feedback to refine the product and validate its ability to solve the problem the customer needs resolved. Often an iterative process yet very valuable in getting the product right.

Why the answers are important

For a technology to become a product it must solve a customer’s array of pain points and input/information from customers is required to make this happen. Why? Because a technology is not a product until it is a solution for a customer.

Regardless of what profile type you think you might fall into, conducting a market assessment and a market validation analysis is an important step in the commercialization process. It saves time and valuable development and marketing resources by testing a product concept, idea, position, and customer buying drivers before a product is launched or engineered.

My proven approach in conducting market assessment and market validation analysis can help any entrepreneur step through the process to get to the right markets and transform their technology into products.

I am currently writing an e-book to reveal my secrets for entrepreneurs. Let me know if you would like a copy once it is ready. Or just give me a call and I would be pleased to share my thoughts with you.

What’s holding you back in 2013?

One of the most amazing stories I read in 2012 was about Felix Baumgartner’s supersonic freefall from a specially made helium balloon. His successful jump from 128,100 feet / 39.040 meters on October 14 broke several records not the least of which was becoming the first person in freefall to break the speed of sound – exactly 65 years after Chuck Yeager first broke the sound barrier flying in an experimental rocket-powered airplane.

Check this short video clip and see what I mean –

http://www.youtube.com/watch?v=FHtvDA0W34I

Felix had a vision all his life of sky diving and piloting helicopters. When he was 16 years old he began sky jumping and built a solid career and skill set in this activity.

So, why I am so impressed by his story? Felix exemplifies the power behind execution and the essential habits necessary in achieving a vision. Here’s what we can learn as entrepreneurs.

1. Preparation

Baumgartner didn’t begin his preparation for his Oct 14th jump months or even years before it happened; his preparation began with his dreams as a young boy at a nearby airport watching sky divers’ parachute from planes. He signed up to start learning to jump as soon as he was legally able to do so, and eventually enrolled in the military to further refine his skills. Over the years he has achieved so many unique sky diving feats all of which prepared him for his leap from the edge of space on October 14th.

Preparation is a series of incremental steps which build toward a desired outcome. In general most business people don’t do a great job in preparation. Why? It seems we all can get caught up in our belief systems or gut assumptions without working through the rationale and details behind our decisions and action steps. What eventually snags any hope of progress is not taking the time to prepare the right information and/or skills sets that will advance our desired outcomes.

2. Knowing how to build an expert team to support you

Felix also assembled an expert team of engineers, flight specialists and even relied greatly on his project mentor Col. Joe Kittinger who holds the world record for the longest freefall.

No one can achieve a vision or goal without the support of others. Even an entrepreneur with an abundance of knowledge and experience will need to rely on people smarter and possess specific insights that make the project team that much stronger during implementation.

3. Focus and discipline on a few, meaningful priorities

As I mentioned earlier, Baumgartner had a dream – a singular focus on sky diving and he had the discipline to follow through. How often have we seen the “spray and pray” approach in getting things done? Lists upon lists of things to do; yet priorities never get done. Things get started but they never get finished. Chet Holmes in his book, “The Ultimate Sales Machine” wrote – “Success isn’t about doing 4,000 things; it’s about doing a few things 4,000 times.” What this means is focus on a few priorities and dig deep in making them happen. Have the discipline to stay on course.

4. Courage to take the plunge

I get goose pumps every time I see Felix take his step away from his capsule into space and freefall rapidly to earth. What a feeling it must have been to take the plunge after so many decades of work toward achieving this final goal.

So, how often do we make excuses, delay or fret over the fear that we might fail in achieving our goals.

So what’s holding you back from achieving your goals in 2013?

What are the top things you should – do better, eliminate because they are holding you back or amplify because you are good at doing it? Once you set your priorities above all else – implement. This is the number one driver in achieving your goals. Implement with preparation, by leveraging a team, with focus and discipline and with the courage to take the plunge.

Best wishes for your success in 2013!

Incubators and Accelerators. Do They Work?

Over half of all startups are dead in the water within 2 to 5 years. This certainly may help explain the exponentially popular appeal of business incubators and accelerators, which promise to boost the chances of individual startups to raise capital, get to a positive revenue stream and provide community benefits like higher regional employment.

There were about 12 incubators in 1980 and today they number in the thousands in the USA alone. Some of the most famous ones are Y Combinator or TechStars. Even governments are getting into the act: the Obama administration in White House has launched Startup America to facilitate public and private partners investing in American entrepreneurs.

In different ways, incubators and accelerators aim to leverage high-quality mentorship and access to funders to produce dramatically different results; but do these methods actually work? (more…)

Why a Capitalization Table is Important

Entrepreneurs are often confused and sometimes even frightened when an investor asks to see the “cap table” or capitalization table. If an entrepreneur doesn’t have a capitalization table then there is great deal of fear to be had and it’s not because the investor is asking for this document. It’s because the entrepreneur has not done a very good job in structuring the financial building blocks of the company namely the number and price of shares that make up the “capitalization” or valuation of the company.

- (Click to download the YCE Capitalization Table product. It’s FREE)

A capitalization table is an important document because it shows who owns the company and what they paid to obtain the shares for this ownership. If you are accepting money from investors you must have this document as it shows two important elements that:

- You have done the proper paperwork in documenting ALL of the shares offered by the company.

- You have established a valuation (price) of each share at each subsequent round and can provide a rationale for the share price being established resulting in an overall company valuation

A capitalization table is important because if it is not kept up to date and investors that you have accepted money from are not on the list – law suits can fly. Worse yet, if a new investor finds out that there are investors that are unaccounted for and not on the list, it is a sure fire fact you’ll never see a dime from that investor. Trust being an important factor in any transaction.

Principles of Capitalization Tables. Tell the Investor a Story

A good capitalization table should be guided by the following essential principles.

- It should do more than just list the names of all the shareholders and their respective share ownership numbers and percentages. It should tell an investment story by chronicling appreciated value of the company over time.

- It will show what type of investor came in at each round and the associated share price paid by these investors at a point in time and is used as a forward looking tool to see the impact financing decisions on ownership, dilution and capitalization values of the company over time.

- It should be the cornerstone in making sure all the paperwork is properly registered, filed and distributed when money is exchanged for equity. For example, paper work needed by the Securities Commission to be filled out by the investor, promises made to others via verbal agreements are then fulfilled and logged in a paper trail with the issuance of share certificates (make sure your lawyer controls these).

- It should be used as an important tool in the establishment of a fair valuation for the company by rationalizing deal arithmetic into a clear and concise document.

I will be covering more about capitalization tables in the weeks ahead to help entrepreneurs understand the components of a good cap table, how to use them, and how deals are structured with them.

Forecasting and Financial Modeling

All forecasts are wrong. What a statement to start with, but it is true. If we could depend on forecasts as a correct indication of certain future states, our world would be totally different. We would know with certainty what the future would bring and this would have a profound effect on how we would behave. So when an entrepreneur approaches financial model forecasting it is a “best guess” rendering of what the company might look like in the months or years ahead. So as a guess, we must therefore not rely on these forecasts as factual renderings.

All forecasts are wrong. What a statement to start with, but it is true. If we could depend on forecasts as a correct indication of certain future states, our world would be totally different. We would know with certainty what the future would bring and this would have a profound effect on how we would behave. So when an entrepreneur approaches financial model forecasting it is a “best guess” rendering of what the company might look like in the months or years ahead. So as a guess, we must therefore not rely on these forecasts as factual renderings.

What financial models do provide is the opportunity to paint, through numeric terms, what could be in store for the company and also assist in guiding decision making.

A financial model requires many assumptions to be made about the future. Future demand, operating and administrative costs, interest rates, inflation, and inventory levels are a few items that are inputs to the financial models of the company. Therefore, a financial model can only be as good as the assumptions and forecasts that are put into the model for analysis.

Some interesting and famous forecasting statements provide an indication as to how difficult it is to forecast new or emerging technologies:

- “Theoretically, television may be feasible, but I consider it an impossibility–a development which we should waste little time dreaming about.”

– Lee de Forest, 1926, inventor of the cathode ray tube - “I think there is a world market for maybe five computers.”

– Thomas J. Watson, 1943, Chairman of the Board of IBM - “This ‘telephone’ has too many shortcomings to be seriously considered as a means of communication. The device is inherently of no value to us.”

– Western Union internal memo, 1876 - “Computers in the future may weigh no more than 1.5 tons.”

– Popular Mechanics, forecasting the relentless march of science, 1949 - An official of the White Star Line, speaking of the firm’s newly built flagship, the Titanic, launched in 1912, declared that the ship was unsinkable.

The last quote is a perfect example of relying too heavily on the assumptions. Since the future is almost always uncertain, relying on point forecasts and ignoring variability is the first and foremost mistake made in forecasting. A ‘point forecast’ for example is an assumption that sales for the next quarter will be exactly 400 units. How many of us would bet that this number is going to be correct particularly in fluctuating markets. All that can be done is to make the best effort in thinking about as many influencing variables as possible; but even then there are no assurances that a forecast will be correct. Here is some “food for thought” that might help.

There are several ways to incorporate variability into your forecasts so as to arrive at better assumptions. An introduction to these methods follows.

Qualitative Methods

These methods are useful for when the future is highly uncertain. For example, forecasting demand for new and innovative products would benefit from following certain qualitative methods. A number of different qualitative forecasting methods are:

- Executive judgment

- Market research through customer visits, surveys, etc.

- Panel consensus – whereby managers, executives, key decision makers, and customers can reach consensus about future outcomes. A good tool that can facilitate this is the ‘Delphi Method’. This is a facilitated system that structures the anonymous contributions made by a panel of experts on a certain subject area. It usually results in consensus around the subject matter after a few rounds of contribution by the experts.

A major mistake is to use point forecasts, derived from any of the above methods, directly in the financial models. A measure of uncertainty has to be captured so as to mitigate the underlying risks of point forecasts. One way of going about and doing so would be to use some sort of probability distribution theory (such as the normal distribution). Going into the mechanics of these models and theories will be out of the scope of this article.

Quantitative Methods

These methods are most useful for products which have longer life-cycles and are less prone to uncertainty. The major assumption behind these methods is that future outcomes will be based on, or is a function of, historical outcomes.

The following are some of the most popular quantitative techniques used for forecasting:

- Time series analysis

- Moving average – This method smoothens past data fluctuations and can be used to base future outcomes on the most recent past data.

- Exponential smoothing – Very similar to moving averages but also automatically assigns weights to past data. Double exponential smoothing is an extension which is used when there are trends in the data.

- Regression analysis – This method is useful for trying to find relationships in data, such as trying to explain dependent phenomena through independent ones. The major use of this method is to understand trend and seasonality.

- Causal forecasting

- This method tries to understand and discover correlations between the outcome to be forecasted and other factors such as price discounts, promotions, economic factors (e.g. interest rates), marketing communication campaigns, etc.

Tips and Takeaways

Forecasting is mainly based on past observations and historical data and is therefore prone to inaccuracies. There are scientific and proven ways to improve forecasting, some of which were introduced above. The following is a list of useful tips for entrepreneurs relating to financial modeling forecasting:

- Point forecasts are almost always incorrect and variability needs to be built around them. This can be done by building different scenarios and assuming different future outcomes for each respective scenario. Then assigning probabilities to each of the expected scenarios. This simple technique results in a probability adjusted forecast that can be much more accurate than the point forecast.

- The longer the forecasting period, the more inaccurate the forecasting becomes. Therefore, do not put much weight behind forecasts three years or more.

- Forecasting aggregated data (such as total sales of all branches of a company) is always more accurate than forecasting disaggregated data (such as sales of each of the company’s branches). The reason is the more micro you go the higher the probability of error because many more variables have to be assessed.

- Always use sensitivity analysis to predict for the extreme future outcomes. This will allow for proper planning and preparation for the worst, best, and most likely future outcomes.

An Investment Value Proposition

An investment value proposition is the overall monetary value an entrepreneur proposes his company will deliver at some future point to the investor in exchange of the investor’s money. The exchange the investor is looking for is a higher multiple return on the capital invested in this company than what could be derived from existing public market instruments such as shares on a stock exchange. Investors look for higher returns because of the risks involved with entrepreneurial companies however wage their capital in the hopes the returns will be far higher than traditional investment instruments.

An investment value proposition is the overall monetary value an entrepreneur proposes his company will deliver at some future point to the investor in exchange of the investor’s money. The exchange the investor is looking for is a higher multiple return on the capital invested in this company than what could be derived from existing public market instruments such as shares on a stock exchange. Investors look for higher returns because of the risks involved with entrepreneurial companies however wage their capital in the hopes the returns will be far higher than traditional investment instruments.

Elements of an Investment Value Proposition

A product value proposition has a number of critical elements that form the value offering to customers. The design of the product is tailored to the unique needs of the target customers. It addresses the problem and capabilities better than competitors thus creating differentiating advantage in the marketplace.

An investment value proposition is very much like a product value proposition but with differences in the elements of value. The key elements important to investors are described below.

The Nature of the Business and Market

The type of business a company is building and the nature of the marketplace in which it will operate is a major starting point in the evaluation of investment opportunities. The reason for this is high adoption rates in large growing industry sectors provide fertile ground for scalability. What is meant by scalability is the ability to grow a company based upon high metrics of market size and growth rates in an industry which ultimately lead to higher returns for the investor. To use the axiom, “high tides raise all boats” that means in a large, fast growing market opportunities abound for a company to be successful. These conditions signal to an investor the right fundamentals are ripe to look deeper into an investment opportunity. This is why many investors look at industry sectors well over a billion dollars in size and double digit growth rates.

Understand the Market Need

Investors want to know if the entrepreneurial management team has a comprehensive understanding of the customer and how to satisfy their needs. The product offering shouldn’t be a “half inch drill”; it should be a “half inch hole”, that is it should be a product that is a solution to a problem. Using solid market research and analysis, entrepreneurs can improve their chances of securing the investment required by knowing what solutions matter to their customers.

Sustainable Competitive Advantage

Another factor influencing an investor’s decision is whether the business has a competitive advantage and if this advantage is sustainable.

Competitive advantage can diminish over the course of the business due to many reasons. Customers’ perceptions to the product may change over time. Their requirements and needs may change. New competitors will enter the market. Or simply, patents and legal rights held over a proprietary technology or invention might expire. Whatever the reason, entrepreneurs need to demonstrate that the business model identified for the company will be sustainable.

The Management Team

No matter how impressive the product or how lucrative the market opportunity, a capable management team makes a tremendous impact on a company’s success. As it has been observed, the quality of the management team is the deciding factor.

The Milestone Plan

Developing a milestone plan and meeting the milestones as set forth in the business plan demonstrates to potential investors the capabilities of the company through “real live” performance executed by the management team.

Reaching significant milestones that create step-ups in the share price has a powerful benefit for founders and investors. Demonstrating value is the basis of creating a solid investment value proposition.

What Investors Don’t Like to See

The following five mistakes should be avoided when dealing with investors – committing any of these mistakes, even once, may compromise the chance of sourcing the required capital:

- Not explaining the problem the product is solving – In other words, failing to communicate how the product will ease customer “pain”.

- Falling in love with technology and ignoring customer needs.

- Stating there is no competition for the company’s product – Any product has at least some sort of competitive substitute. For example, although the first fax machine had no direct competition, there certainly were other means of delivering messages such as the telephone and postal mail.

- Failing to prepare a detailed financial plan – Entrepreneurs need to demonstrate they know their numbers inside-out and that they have done detailed and careful financial analysis.

- Claiming the financial forecasts are conservative – The moment entrepreneurs say the phrase “we prepared conservative projections” they signal to investors their naïveté. There is no room for wide-eyed optimism.

Columbus and Today’s Entrepreneur – A Common Bond?

Raising capital is not new. In fact, it’s as old as the hills or as old as the sails, if you will considering the fact that Christopher Columbus sailed to the New World with the backing of people who were venture capitalists at heart, if not in name. Columbus, it should be remembered, began his groundbreaking journey across the seas in the 15th century. He was able to sail the uncharted seas and discover the Americas because of the generous backing he received from Spain’s King Ferdinand, even as Queen Isabella remained sceptical.

Raising capital is not new. In fact, it’s as old as the hills or as old as the sails, if you will considering the fact that Christopher Columbus sailed to the New World with the backing of people who were venture capitalists at heart, if not in name. Columbus, it should be remembered, began his groundbreaking journey across the seas in the 15th century. He was able to sail the uncharted seas and discover the Americas because of the generous backing he received from Spain’s King Ferdinand, even as Queen Isabella remained sceptical.

Of course, King Ferdinand was no venture capitalist, as the term is understood today. But at heart, and in his behavior, he was no different. He was a royal patron who, guided by profit and perhaps greed, looked for new lands to conquer and later plunder. Fueled also by a sense of adventure, King Ferdinand gambled on Columbus’ proposal to chart a western route to China. As business plans go, Columbus’ was not very different from what one sees today from entrepreneurs.

Few understood Columbus’ plan and it would be fair to say, many were downright cynical of its success. The rulers of Portugal, England and Genoa and Venice rejected his plan. Columbus displayed amazing persistence and possessed inordinate motivation. He sought out Spanish friars who served as his angel investors and tapped the royal networks, leading the reckless adventurer to the court of King Ferdinand and Queen Isabella. Even Spain’s royal couple initially turned him down, agreeing with some others that his plan was “impractical.” Still, Ferdinand and Isabella initially conferred on him an annual annuity of 12,000 maravedis ($86,000) and furnished him with a letter ordering all Spanish cities and towns to provide him food and lodging at no cost—ostensibly because they didn’t want him to take his ideas elsewhere, a trick employed by modern-day venture capitalists.

Finally, Columbus struck success in 1492. Ferdinand and Isabella, who had just conquered Granada, the last Muslim stronghold on the Iberian peninsula, received Columbus in Córdoba, in the Alcázar castle. Still, Isabella turned Columbus down on the advice of her confessor. But as he was leaving town in despair, Ferdinand intervened and decided to fund Columbus’ expedition. Much like today’s venture capitalists, Ferdinand later claimed credit for being “the principal cause why those islands were discovered.”

According to the term sheet Columbus successfully negotiated, he would be entitled to 10 percent of all revenues from the new lands he discovered; and he would have the option of buying one eighth interest in any commercial venture with the new lands and receive one-eighth of the profits. What happened after his discovery is another story though.

What can we learn from this famous historical story?

First: investing capital in risky ventures with the possibility of never seeing your money again is not something new. Royalty in several countries initially turned down Columbus. Secondly, having sponsors or advisers to help position your story to the “money people” can increase your chances of funding your venture. Columbus was helped by the Spanish friars. Thirdly, your potential investor must see a value greater than the money being invested or put another way—your venture must provide the possibility of attaining outstanding riches, even unimagined riches which is what the Spanish royal couple dreamed of. And finally, Columbus was the classic entrepreneur. He never gave up. He sought many investors. He found creative ways to reach some investors.

I guess the more things seem to change the more they remain the same— financing entrepreneurial endeavours have changed little over centuries.

Raising capital is difficult. It will seem acute, and probably frightening, if you have never before asked money from a stranger. I know that firsthand.

In late 2001, I was president and CEO of a technology start-up. It was probably the worst time to start a technology company, given the almost overnight demise of the technology investment market now affectionately called “the dotcom bust.” I was successful in raising $2 million in second round financing but as the weeks and months wore on it became increasingly impossible to find investment funds for our venture. Our sales slowed as no one had the money to buy our product. And over time our burn rate reduced our dream to ashes. This was the hardest and saddest time of my business career.

But I did learn from this experience and went on to establish two more start-up both very successful. Here’s what to remember.

First, launching a company costs twice as much, and takes twice as long as expected to get going. Timing is everything when running a company. One ill-timed move or circumstance can spell doom.

The other thing I learned was that you need to do your homework well and execute plans to build investment value. Demonstrate real time your company can hit significant “value building” milestones. Make it attractive for investors to buy the equity of your company.

And finally, I came to the realization that raising capital is 80 percent perspiration and 20 percent luck—increasing your odds by creating investment value in all areas of your company is the key to success. Show ‘em value and you’ll see capital!

So what I have done from my experience is to write a book to help entrepreneurs raise equity capital. My book is entitled – Your Capital Edge™. This book is full of tips, examples, and insights to make navigating the wonderful world of finance a little easier. Armed with the information contained in the book, entrepreneurs can improve their chances of getting the capital they need to support their dreams. Not only that, but I have designed and developed this website to provide you with the tools you need in order to diligently prepare your material and value proposition for potential investors. Furthermore, this website will be kept updated on a constant basis and new articles, tools, and videos will be added on a monthly basis.

Browse Our Blog

- Angel Investors

- Articles

- Business Strategy Tips

- Company Valuation

- Crowdfunding

- Due Diligence

- Entrepreneur tips

- Financial Forecasting

- Financial Modeling Tips

- Going Public IPO

- Government grant business

- High Tech Startup News

- Invest in a business

- Market Research Tips

- Raising Investment Capital

- Raising Venture Capital

- Startup entrepreneur tips

- Vancouver business news

- Video

News & Links