Archives

Investor communication – How to effectively communicate your investment story

This e-book on how to effectively communicate your investment story sets the stage for the Sizzle aspect of fund raising.

After reading this e-book you should be able to:

-

Understand the need for a finely-crafted value proposition or pitch

-

Know which “stakeholders” in the success of your company are interested in your value proposition

-

Understand why you and your company can benefit internally from preparing well-crafted presentation materials and value messages

-

Outline what investors are looking for as “red flags” in presentation materials and value messages

-

Explain what an investment value proposition is and why it is important to articulate it clearly

-

Identify key components of value messages that investors are looking for, and what they don’t want to see

-

Know the ten mistakes that you must work to avoid when presenting your communications package, and why these mistakes can be deadly.

Because it is scarce, entrepreneurs must work hard against all other competing interests for the capital they need. If they cannot generate money the old-fashioned way—with revenues—then they must distinguish their company in the fight for equity capital. Confidence must be generated that the entrepreneur’s company can ultimately obtain the kind of returns that make it worthwhile for the investor.

If your investor communication is well articulated and compelling, you will be rewarded with investors’ attention and interest. Once you have achieved that, you have the opportunity to tell the rest of your business story and to move forward to the next step, if interest continues. If you do not succeed in making your value proposition interesting, you will find yourself growing increasingly disenchanted with the fund-raising process.

Investor communication is important for attracting customers, partners, suppliers, employees, strategic advisers, and just about anyone else who can help to take your business forward. If you have a investment story, all of your stakeholders can have some confidence that you can generate market presence, satisfy customers, and obtain revenue.

Well-crafted investor communication materials adds value if done properly, and these materials can also have the benefit of clarifying business focus and identifying the key assumptions required to drive toward business success.

Buy and download this e-book today!

Business Analysis – Measuring Markets an important element in a capital raise

In this e-book on measuring markets we take a detailed look at the elements an entrepreneur must measure, assess and consider when deciding if the business is viable.

After reading this e-book you should be able to:

-

Explain the importance of fact-based business analysis for you, the entrepreneur, and for potential investors

-

Describe aspects of your market, including size, sector, value, and growth potential

-

Explain key concepts involved in undertaking market research

-

Describe the importance of the customer to all aspects of the business

-

Identify common flaws and omissions in conducting market research, and their potential implications for the business

-

Describe some methods for measuring markets and understand the pros and cons of each.

-

Explain components of market research that is of special interest to potential investors

-

Describe key features of customer leverage and how it works to attract investors.

Doing business analysis at each step in a company’s development is the essence of creating substance. Investors like businesses that have substance. It is viewed positively when an entrepreneur has a finger on the pulse of the business and is driving toward profitability, which of course translates into increased shareholder value – this is something that is near and dear to investors and founders alike.

There are two kinds of business analysis: market and financial analysis. It should be noted that there is a wide variety of business analysis topics and techniques that are used in the normal course of business operations, but to address all of them would go beyond the scope of this e-book. Here we will focus on the most important analytical areas to be addressed in the capital raise effort.

Buy and download today!

Deal structure and Term Sheets

This e-book on deal structure and term sheets moves you closer to making a deal with your potential investor(s). It brings into focus the importance of defining the elements that will, over the next period, have significant impact on the success of your company.

After reading this short e-book, you should be able to:

-

Understand what a deal is comprised of and why this understanding is critical to the start-up entrepreneur

-

Be able to describe the differences in needs/expectations of entrepreneurs and investors

-

Be able to outline the importance of a term sheet and its significant for the parties involved in using it

Usually the first step toward finalizing the deal structure is a term sheet the entrepreneur negotiates with the investors and the valuations they offer. All things being equal, entrepreneurs would surely choose the investor who offers the higher valuation. But things are rarely equal in the real world!

As a result, there is any number of differences in deal structure and term sheets the entrepreneur can receive.

Therefore do not expect to see a “one size fits all” term sheet, as each investor will want certain terms based upon his preferences. It boils down to three items of greatest important to investors: valuation, control, and protection.

Overall, most of the criteria discussed in previous e-books apply.

In addition, other factors include: what level of funding can be expected in future rounds, how likely are possibilities for later financing rounds, can syndications with other investors work, and are milestones achievable and associated to the funding objectives?

Buy and download this e-book today!

Snakes and Ladders of Capital Structures

Not all shares are equal, and there are very good reasons for this. This Snakes and Ladders e-book on capital structures seeks to simplify and unscramble the share structure puzzle and provide insights into the wonderful world of value exchange.

Think about this: when you are on the hunt for capital, you are essentially looking to buy capital using the shares of your company as currency.

It is somewhat like a license to print money using share certificates. But remember this: an exchange of shares for cash always has strings attached, creating different classes of shares with differing obligations.

Basically, shares can come in three different forms:

- Common shares

- Preferred shares

- Stock options

At a minimum, one share must have the following characteristics. It must have

- certain voting rights

- the right to receive dividends, and

- the right to remaining property on dissolution (sale or bankruptcy).

The following will present commonalities and differences, and define each class of shares so that you will be able to follow how they affect the share structure of your company over time. This effect is often referred to as “slicing up the pie” – that is, the allocation of share ownership over the various rounds of financing.

This e-book walks you through the structure of shares within a company, the options for them, and the varieties of their use as a company grows.

After reading this e-book, you should be able to:

- Know the significance of share structure: common, preferred, and stock options, and how they can help or hinder the company’s growth

- Understand the basic arithmetic involved in calculating share structures

- Describe the key elements in dilution

- Understand the concept of triangulation and its significance

Buy and Download this e-book today!

Building a Financial Model – free ebook download and learn the steps

Sooner or later, a prospective investor is going to pose this question and a ready affirmative answer should be in the offing. But – why is a financial model important to an investor, and more importantly, to the entrepreneur? You need to know about building a financial model.

Building a financial model is an expression of the company’s business plan, but in dollars and cents. In many ways it is about financial planning, even if the company does not have historical operating figures to work from, and even if it can merely project what might be a logical expression of revenues, costs, and resources consumed over the next number of years.

Many entrepreneurs get panic attacks at the very thought of producing balance sheets and income and cash flow statements, and they are content to hide behind the coat tails of their accountants. Although an accountant is a necessary advisor, the entrepreneur ultimately has to have a solid knowledge of the key financial drivers and assumptions of the business.

It is not the accountant who will explain details to investors or answer their queries. The entrepreneur needs to understand each number and the implicit assumptions behind it. Investors expect the entrepreneur to know their break-even point, burn rate, and the leading assumptions underlying your business. The entrepreneur needs to know their numbers – cold!

Check out this free e-book and learn the important steps in building a financial model

Equity Crowdfunding Primer e-book

There are four types of Crowdfunding – donation-based (money provided to a charity or a cause), lending based (money provided to an individual that must be paid back), equity-based crowdfunding (money provided to a company in return for shares). Finally, reward-based crowdfunding (which is money provided in return for products, experiences, promotional items, or some other form of perks).

The Crowdfunding you will read about in this e-book is equity crowdfunding which is allows qualified individuals in the “crowd” to own a share of a company in exchange money.

This e-book will give you a great overview of the equity crowdfunding industry as of 2015 and provides up to the minute overview in the securities regulations shaping the way this type of crowdfunding is being offered.

Entrepreneurs wishing to get involved in equity based crowdfunding have to ask this one basic question at the very beginning of any capital raise journey.

Is my company fundable?

To help answer this question, an entrepreneur needs to be understand that they are building is a company that is fundable. It basically boils down to building a company that can show promise in delivering a ROI for investors. It goes well beyond just having a business plan in hand, all the regulatory documents prepared and a landing page on an equity crowdfunding site. The entrepreneur must demonstrate in every way that he or she is building a sustainable business that will have enduring value.

The e-book outlines the important steps in initiating an equity crowdfunding campaign and offers important insights on what works and what does not work in initiating a campaign project.

FREE DOWNLOAD

Reward-based Crowdfunding Primer e-book

there are four types of Crowdfunding – donation-based (money provided to a charity or a cause), lending based (money provided to an individual that must be paid back), equity-based (money provided to a company in return for shares). Finally, reward-based crowdfunding (which is money provided in return for products, experiences, promotional items, or some other form of perks).

The Crowdfunding you will read about in this e-book is reward-based crowdfunding which is allows individuals in the “crowd” to contribute to an organization, individual, cause or artistic endeavor in exchange money for a perk, reward or experience.

The typical way entrepreneurs think of raising equity capital there is the same linear view taken about launching a reward based Crowdfunding campaign.

Most view a reward-based crowdfunding campaign like this:

- Post a Campaign

- Engage Audience

- Get Funded

- Track Analytics

- Collect $$$

- Fulfil on Perks/Rewards

Well you guessed it … this is only part of the picture not the whole scope of what is needed.

A reward-based Campaign begins and ends with your idea. However, the first thing you have to ask is “Crowdfunding right for me and my company?” It is not suitable for all companies for a variety of reasons which I will get into later in my presentation.

Secondly, there is a considerable amount of pre-planning tasks that have to be undertaken before you switch on the Crowdfunding launch button. This is where many Crowdfunding campaigns fail and where entrepreneurs underestimate the time, resources and effort that it takes to launch a successful campaign. Two – Three months of preplanning is a must.

Thirdly, the statistics have proven that a campaign that lasts between 30-60 days is the most effective in terms of duration. Why? Because if you have done you pre-launch planning really well then this is enough time for your campaign to go viral without a fatigue factor setting in for your audiences.

Finally, even if you bag the money you wanted to raise, you still need to continue the trust and fulfill on the promises you made to your supporters. Campaigning should not come to a full stop after 30 or 60 days.

You have to think of it in the context of the long term as you are creating a venture about which you are passionate and want to see sustainable. Who wants to see their passion die on the vine?

This e-book provides a comprehensive primer on what work and what does not work in planning a reward-based crowdfunding campaign.

Download this free e-book today!

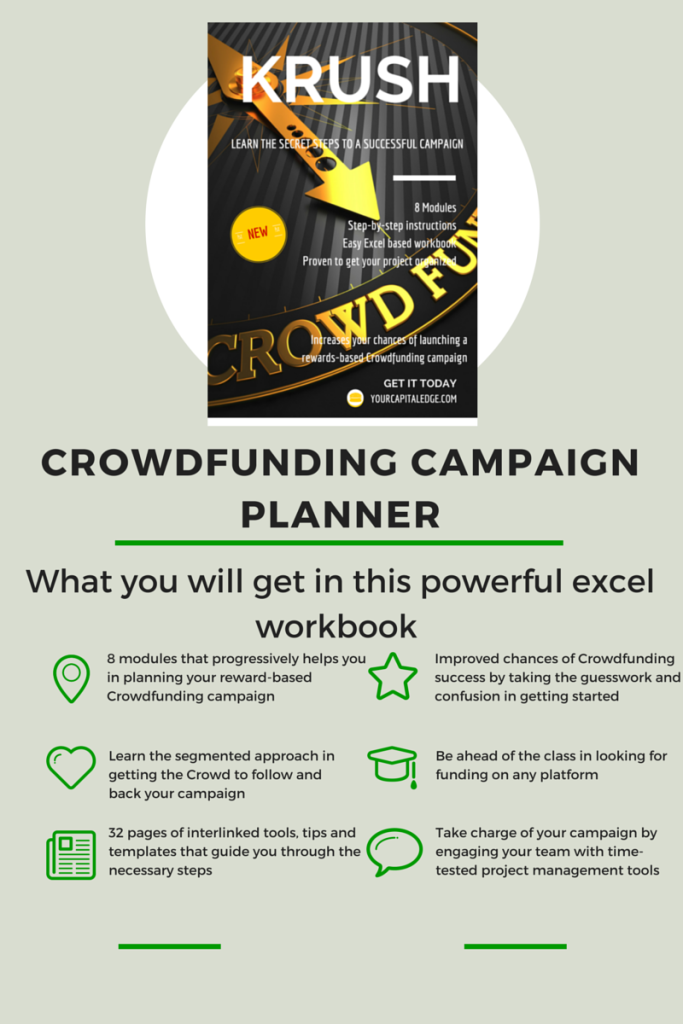

Krush Crowdfunding Campaign Planner

Stop being over-whelmed in planning you reward based Crowdfunding campaign. With this great tool you will be able to systematically plan and execute all of the details to get the money to fund your idea, business or cause. This step by step planning tool can guide you through the details in creating a successful campaign.

This Krush™ Crowdfunding campaign planner is filled with tools, templates, questions and tips to help you plan your reward based Crowdfunding campaign. It consists of 8 interlinked modules each of which segments the planning and decisions which have to be made before launching a Rewards Crowdfunding campaign.

Why is this important to you? Because advanced and focused planning will increase your chances of getting the money you need from your campaign. You want to “Krush” your campaign and you want the Crowd to have a “crush” on what you are doing!

The Krush™ Crowdfunding campaign planner is a valuable tool for entrepreneurs looking to raise money for their cause, artistic endeavor or product. It is logically laid out and is intuitive for any one to use.

There is not a Crowdfunding tool like this on the planet. Don’t miss out in using this tool because it will save you tons of time and money in getting your campaign plan right!

Downloadable Excel Crowdfunding Campaign Planner – valued at $99.95.

It is worth every penny. Download today!

Take this video tour to see first hand how it can organize your campaign.

Government Grants Directory -Canada

CANADIAN BASED

There are many government agencies that support technology companies by supplying either grants or matching contributions. These non-dilutive funding sources are very valuable to any entrepreneurial company wanting to make every dollar stretch. There are two separate directories, one for Canadian based companies (41 pages) and the other for those companies headquartered in the United States (27 pages) looking for grants in their respective countries. Price per directory – US$4.95 each

Due Diligence Checklist – get organized for investors

Sooner or latter an interested investor will want to dig deeper into you business and confirm everything you have presented in your presentations and discussions. Having all of your due diligence materials and documents can a) accelerate the process of making a deal and b) provide the underlying confidence and trust in you and your company.

But what do investors want to review? How can I make sure I have the information they are looking to assess? Where do I start?

This 6 page due diligence checklist provides an comprehensive list of the typical things that are reviewed by investors during the due diligence period. It outlines the type of documents and information an investor will likely be looking to review and forces you to get them organized and readily available ahead of time.

If you don’t do this you can delay your deal from getting done and worse have a prospective investor loose patience then move on. The preparation of due diligence materials and information helps get your company’s affairs in order and gives you the peace of mind you are ready for any question, any request and anything an investor throws your way.

Due diligence checklist – to organize the materials an investor will be looking to review

Browse Our Blog

- Angel Investors

- Articles

- Business Strategy Tips

- Company Valuation

- Crowdfunding

- Due Diligence

- Entrepreneur tips

- Financial Forecasting

- Financial Modeling Tips

- Going Public IPO

- Government grant business

- High Tech Startup News

- Invest in a business

- Market Research Tips

- Raising Investment Capital

- Raising Venture Capital

- Startup entrepreneur tips

- Vancouver business news

- Video

News & Links