Business Strategy Tips

Finding the Hook to Strategy Implementation

“90% OF ORGANIZATIONS FAIL TO EXECUTE THEIR STRATEGIES SUCCESSFULLY.” Kaplan & Norton

A frightening statistic! Yet we have been trained that without a strategic plan a company is doomed for failure.

“STRATEGIC PLANNING AT A POINT IN TIME DOUBLES THE LIKELIHOOD OF SURVIVAL AS A CORPORATE ENTITY.” Noel Capon, James M. Hurlburt, Columbia University

So then, if companies can get the implementation right then the failure rate will go down and the survival rates will go up. Sounds like a plan (pardon the pun) but let’s really get to the root of the problem if we can.

I am sure you have heard of Murphy’s Law, Moore’s law and other similar laws which are based on relationships or concept translated through ratios. Well, here is one for you it’s called …

“Blanchard’s Law”, why not, and it relates to the key factors necessary for successful strategy implementation.

Here’s it is:

An organization’s success at strategy implementation =

The organization’s ability to effectively mobilize its resources and focus on strategy/ The organization’s ability to reduce the resistance in achieving buy-in and accountability

This means that the implementation of an organization’s business strategy (direction) is equal to the ability to mobilize the people, processes, systems and technology in an organization (power), divided by the organization’s ability to achieve buy-in, discipline and focus on the implementation of the strategic plan (resistance reduction).

What does this mean?

If an organization has the ability to actively mobilize all of its resources at 100 units and yet is held back by resistance to implementation by a factor of 10 units the resulting quotient or outcome is 10. In other words, if the level of resistance goes up the ability of the organization to implement strategy goes down. In this case, the organization is relegated to the lowest common denominator of strategy implementation of 10 units.

However, if the same 100 resource units faces a resistance factor of 2 the result is a 50 unit implementation factor. Thus, if the level of resistance goes down then the effectiveness of strategy implementation goes up.

The take away, reducing resistance is the key.

Simple huh, but why is it so difficult to address. I mean if an organization can reduce the level of resistance in the way it implements strategy the greater will be its productivity – why just do it.

The big question is how can this be done?

According to a study conducted by Canadian Society of Association Executives (CSAE), it determined there are clear patterns that emerge in successful strategy implementation efforts.

They observed three common-sense tests:

A. Manage to results milestones;

B. Explicitly addressed the people issues within the organization relative to strategy execution, and;

C. Resource properly, not just with money.

The CSAE also found that even the soundest strategies failed to achieve their performance objectives because one of these tests was flunked.

So getting all three tests right is important.

And getting them all right is a tall order if an organization relies on 20th century tools for implementation. How can an organization expect to win at strategy implementation using memos, presentations, occasional plenary workshops and performance compensation plans?

These are tools that can be a good start, but we are now in the 21st Century and powerful, integrative digital tools are now at our disposal. These tools can help to define outcomes, measure and then track strategy as it is implemented.

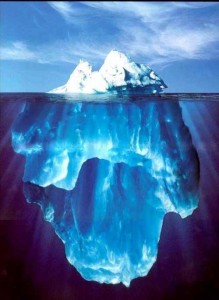

Using technology for strategy implementation is not just a one-time thing; but an integrative effort to instantly get at the underbelly of how strategy can be managed in an organization. Not only vertically and across an organization’s structure but to penetrate the very DNA of its culture as well.

I recently encountered a company called Envisio. They have spent the time and money to answer the 21st century call for a technology to help with strategy implementation. Envisio’s cloud based software can reduce the factors that create resistance holding an organization back. It gets at the very problems of implementation and allows for the revitalization of the strategic planning process as well.

Here are the key points in reducing resistance that makes the Envisio software so unique:

ACTIONABLE

Envisio provides a structured approach in creating and translating strategic plans into individual and team activities with measures. This way the organization can pinpoint resistance points and shore them up to improve implementation outcomes.

CLEAR

Everyone within the organization is assigned a role and responsibility to bring the strategic plan to life. It means that people become strategic thinkers making their contributions meaningful and accountable toward a common purpose. There is no room for ambiguity.

IN CONTEXT

Dashboards provide a view of individual activities and measurement that connect them to the plan. This allows the people in the organization to understand how they fit into the strategic plan and how they can reach strategic objectives.

DYNAMIC

Plan updates are automatically recorded and communicated to teams and individuals. Strategy implementation means all hands on deck working together in making things happen.

MANAGEABLE

Intuitive reporting revolutionizes management’s ability to track progress against the strategic plan and make adjustments when circumstances dictate. Remember there is no such thing as a perfect strategy so managing strategy under fire ensures management has its finger on the pulse.

I invite you to check out Envisio’s website to learn more about their technology and the unique opportunities it provides organizations. Envisio developed, markets and supports an easy-to-implement web-based strategy implementation software that flows from an organization’s strategic plan. I encourage you to visit – http://www.envisio.com/ for more information.

Lean Strategy Development – Moving from Attachment to Adaptation

“If you always do what you’ve always done, you’ll always get what you always got.” – James P. Lewis

“If you always do what you’ve always done, you’ll always get what you always got.” – James P. Lewis

Why do strategic planning? Is it really helpful to plan when things around us are changing so rapidly? Look at the current business environment that is changing as fast as quick change artists in a theatre show.

The rate of change as we have discovered is so fast that traditional planning horizons just can’t keep up and current planning techniques are obsolete. This means organizations are often caught with their pants down before they can realize on their previously planned outcomes.

So what has to shift in how organizations approach strategic planning? The answer –they must leave behind their attachment to traditional strategic planning approaches and move toward a lean and iterative strategic management process.

Here are five principles to help an organization create a strategic adaptation culture.

Focus on one goal at a time – Abridge

Focus is essential in any activity. Confusion results when there are too many directions undertaken at once.

For example, in the sport of football the single focus is to bring the ball into the end zone and score. Note I was very specific to indicate that it was not to score a touchdown because a field goal could very well be the way to score points as well. During a game the players focus on bringing the ball down the field concentrating on crossing the line of scrimmage consecutively. The goal is to reach the end zone and score – how it is done is a matter of tactics and team work.

For organizations the same is true. Having a clear and defined goal to focus on means that everyone in an organization will know what is expected of them and what is needed in getting the goal achieved. Keeping the goal simple and focussed allows organizations to create a rallying call for what ultimately matters strategically.

Build a culture that anticipates near term trends – Anticipate

Drawing again from sports, Wayne Gretsky once said, “I skate to where the puck is going to be, not where it has been.” This insight speaks to the element of anticipation. In the context of strategic implementation it means every person in the organization should be responsible for predicting future outcomes and brace for them. A strategy conscious organization should build a culture in which anticipation is encouraged and practiced regularly.

Empower employees to make decisions based on context – Adjudicate

It is virtually impossible for any executive or manager to make every decision in an organization. What is necessary is that employees be given the right and freedom to make decisions within the context of a single overarching goal. This means that they must have the ability to make decisions on the fly when changing circumstances dictate. This ability to adjudicate allows for a nimble and focussed organization that implements through the collective wisdom of its members.

Adjust and pivot in response to new circumstances – Adapt

The “Ready, aim, fire” business principle was changed in the ‘90’s to “aim, fire, aim, re-fire”. Why? Because it is always best to adjust to changing circumstances using a test and fine-tune mentality. If something isn’t working make changes to get it right and don’t stay long with a losing approach.

Tactics are stepping stones that provide the pathway to achieve the ultimate goal but also must take into account environmental dynamics to make adjustments. In business environments that are constantly changing, adaptation is essential in shaping a lean, iterative and adaptive plan for an organization to follow.

Constant motion toward the designated single goal -Activate

Finally, organizations are in a constant state of motion relative to their changing environments. Albert Einstein’s theory of relativity is, so to speak, relevant here. (Smile). He postulated that the faster an object is moving, the slower time progresses for that object in relation to a stationary observer. In other words keeping up with the changing environment requires an organization to be in constant motion – adjusting and adapting to fluctuating changes in order to keep on top of the things that are impacting its success.

Keeping in motion means an organization is learning and adjusting to decisions that are in many instances both wrong and right at any given point. Adjustments or deviations from the path are okay as long as the goal is being focused upon.

The Five Fallacies of Strategy Planning

Okay, we have seen this before. Business executives hustle off for a strategic planning retreat with their briefing binders in hand and the burning desire to come out of a planning session armed with a revitalized and innovative business direction for the company.

Didn’t this happen last year?

Remember the sacred strategy document that was produced. This plan espoused the direction needed to unlock the company’s future advantages and represent the flint for change, prosperity and success. Nirvana at last!

Sounds exciting.

But sadly the swirl of enthusiasm drops off rapidly after the days following the retreat and the many weeks after the strategic plan is written.

So why do organizations repeat the same strategic planning processes year after year believing they are loyally continuing a traditional planning cycle that will lead the company to the Promised Land?

Let’s explore five main fallacies that need to be changed to make way for a completely fresh approach to strategy development and implementation.

Lore 1: The more time spent on strategic planning the more successful the business

There is absolutely no correlation between the length of time spent in strategic planning and the beneficial outcomes to a business. In fact, the more time spent on strategic planning the more management will get caught up and it becomes the focus. This promotes planning paralysis and any benefits which could be accrued are eventually lost as momentum declines.

Lore 2: Diligently analyzing every aspect of the company’s market

Yes it is hard to argue that knowing the market is a good thing, however over analyzing and creating piles of data files or studies can lead to planning paralysis that will stymy strategy development. Furthermore, some analyses can be backward rather than forward focussed causing a loss of perspective on future outlooks about where the company should be directed.

As the saying goes, knowledge is power but too much knowledge can turn any circumstance into a sea of endless options about which confusion and procrastination reins.

Lore 3: A solid, good strategy is the key

A well-conceived strategy can be blindsided. It is difficult to predict changes in the marketplace as most strategic planning tends to use past information to predict future states. A good strategy has to be flexible enough to roll with the dynamics of changing external and internal environments.

Strategic plans, once developed, represent perspectives made from the contextual view at a single point in time. The circumstances in the next timeframe can render the plan obsolete.

In addition, a great strategy cannot come alive without good solid leadership and this leadership has to come from all parts of the organization. Mobilizing a leadership culture around plan implementation is a critical element.

Lore 4: Strategic thinkers are best at strategy development

The belief that strategic thinking is the privilege of only a few individuals in an organization promotes an exclusionary point of view. It represents an exclusive club mentality where only the elite are recognized as the gifted ones who have the intelligence to create the future direction of the company.

There is also a viewpoint that to engage a broader group in the strategic planning process will slow it down. The belief is that by relegating strategic planning to an activity focussed more on consensus building is counterproductive when the view is taken that a smaller team can make decisions faster. Is faster better? Sometimes, but not always.

Lore 5: Good communication is the panacea for effective strategy implementation

Most often communicating the company’s strategic plan resembles a prophet coming down from the mountain top and issuing an edict. Although words like “cascading” or “socializing” the strategic direction with employees is often used, the approach resembles a one way water fall of information.

Employees of the organization are given very little by way of understanding the reasons why the strategic direction was established – so context is invariably missing. And they no doubt even secretly harbor resentments about how the edict is being delivered to them. Resistance becomes a product of a toxic culture.

There is not enough in the communication plan to ensure employees have a complete understanding of where they fit in, how the strategic plan will be implemented and how it will impact their day to day activities and challenges. It comes across as a strategic plan in a strait jacket.

So with these fallacies identified my next blog will provide a fresh approach to strategic planning and implementation to show how these fallacies can be overcome.

Death of Due Diligence

Isn’t it interesting how words can creep into our business vocabulary and have completely different meanings from their etymological roots?

Here are a few words that bear little resemblance to their original meaning:

Traction – defined as the act of drawing something over a surface. Today in business it relates to a company’s ability to generate revenue or acquire customers. For example, “the company was able to gain traction in the mobile app sector by acquiring customers”.

Runway – defined as a specially prepared surface along which an aircraft takes off and lands or a raised gangway in a fashion display. Today it means a company’s longevity to sustain revenue or cash flow. For example, “the company has enough cash in the bank for a runway of three years before the next capital raise is necessary”.

Don’t you miss Andy Rooney?

He would have had something brainy to say about our business vocabulary. You have to love his sarcastic wit. He once quipped – “The dullest Olympic sport is curling, whatever ‘curling’ means”. How true! Sorry curlers.

Well, I came across another word that is being embraced in the investment world and it is – “curation”. Curation is the new due diligence aimed at delivering high quality deal flow or investment prospects to investors and backers. It refers to the process of vetting deals to scrutinize losers from winners.

Although this seems to make sense on the surface, the way I see it the problem resides with those doing the curating. Why? Because if they are not very good at using their curation crystal ball to pick winners then the process is flawed. These gatekeepers to capital have to be really good at screening the good deals from the bad ones to generate positive investment outcomes.

Due diligence or curation, although a practice that provides a certain level of comfort to investors as a hedge in risk mitigation, cannot be relied upon entirely. The statistics on start-up failures are a testament to how terrible existing practices are in delivering on the promise. We know these top picks eventually result in a whopping 80% plus in business failures.

I see interesting differences between the curation processes for Crowdfunding and the more traditional practises used by Angels and Venture Capital Funds.

In my mind Angels and VCs represent the few that make decisions for the many about who will get funded and who will not. A lot rides on their curation prowess, and the stats prove it is not efficient.

Crowdfunding takes out the middleman or the gatekeepers and replaces them with the wisdom and the hearts of the Crowd to make better predictions as to the winners that get funded. Let me explain.

In James Surowiecki’s book “The Wisdom of Crowds” he maintained that large groups of people, even non-expert people, are very often smarter than an elite few no matter how brilliant those few may be. The author provides numerous examples of when groups have proven better than individuals at solving problems, fostering innovation, coming to wise decisions and most notably, predicting future outcomes. Intriguingly, group members don’t need to be particularly smart on an individual basis in order to be very smart on a collective basis.

Here are some interesting trading platforms that use the power of the crowd as prediction markets.

Hollywood Stock Exchange (HSX)

The HSX is a virtual, online stock exchange where traders buy and sell virtual shares in upcoming movies. The HSX sells the data collected from their exchange as market research to entertainment, consumer product and financial institutions.

Since 1996, the HSX has accurately predicted the box office receipts of thousands of movies. According to a study the correlation between the HSX’s predictions and actual opening box office receipts was calculated at 0.93 – not bad since a perfect correlation is 1.0. The HSX has also been used to predict Oscar winners, and so far they’re averaging about 92% accuracy.

Wouldn’t this number be refreshing when it comes to predicting positive start-up outcomes?

Although people self-select to be involved, meaning they choose to be involved. There is no screening mechanism to ensure these “traders” should be ardent movie or entertainment experts. This crowd is large and represents over 1.6 million traders. Such a large sample can be said to be statistically correlated.

Iowa Electronic Market (IEM)

The faculty at the University of Iowa developed the IEM to be an Internet-based teaching and research tool. It allows students to invest real money ($5.00-$500.00) and to trade in a variety of contracts. The use of the IEM is best known for the prediction of political election outcomes.

The University of Iowa has found that even 100 days before an election, the market price predicts the winning candidate about 75% of the time. Political polls predict only slightly more than 50% of the time, and political pundit predictions are way worse. A 12-year analysis of IEM trading indicated that the IEM consistently out-performs political polls in terms of not only choosing the right candidate, but also predicting the margin by which he or she will win.

These examples demonstrate the power of the crowd to make predictions. They do not just indicate the capability to identify winners and losers, but also the overall statistics provide evidence of their accuracy in doing so.

Crowdfunding works on the same principle. Backers vote for their project and they will use their own money to do so. They will back a project if they feel it is aligned with their interests, needs and beliefs. The collective demonstration of social proof is more powerful than any process of curation can ever be, as it elevates winners by using the collective shoulders of the crowd.

Crowdfunding backers, like customers, vote with their wisdom and heart. The current reward based platforms are showing that curation or due diligence does not have to get in the way of positive capital raising outcomes. Although some platforms do vet projects, this is more on the basis of suitability rather than financial metrics. In the end it is the people with compelling projects who motivate crowds to get on their side and provide them the needed capital, which is proving the disintermediation of due diligence.

What I mean is, due diligence is not necessary in predicting winners, and one has to contemplate whether it is necessary at all given the track record of the capital gatekeepers in the traditional investment arena to produce winners. Tapping into the wisdom of the Crowd may be much better.

Business Accelerators. Let Innovation Reign

As part of our research into business incubators and accelerators, we talked with Greenberg Traurig LLP Intellectual Property Attorney Chinh Pham, whose firm is one of many providing in-kind support services for participants in MassChallenge, a Boston-area accelerator, partnered with Startup America, that calls itself the largest accelerator competition in the world.

As one measure of the program’s value, MassChallenge notes that the 111 startups supported in the 2010 accelerator raised over $100M in outside funding and created about 500 new jobs in under 12 months.

We talked with Mr. Pham about the opportunity and challenge of developing an accelerator program in Boston. (more…)

Tracy Kitts on Incubators

While researching our feature on the value of Incubators and Accelerators for startups, we got in touch with Tracy Kitts, Acting CEO of the National Business Incubators Association (NBIA), which bills itself as the world’s leading organization advancing business incubation and entrepreneurship. We had a few questions for him.

How do you meaningfully compare the outcomes of businesses that have gone through the incubator model and those that haven’t?

Researchers are continuing to try to look at the results of companies that go through a program in a specific community and those that don’t. There are just so many variables at play. The best we can do is to take a look at return on investment… (more…)

Business Accelerators. A Startup’s Perspective

While researching a feature on business incubators and accelerators, we came across Chris Hexton, an entrepreneur with Invc.me who has been through the accelerator process and was able to share insight from his own experience.

Having recently progressed through the Sydney-based accelerator Startmate I can safely say that it has certainly been one of the most worthwhile experiences of my life – both for my startup and myself personally.

Before joining Startmate my business partner and I ran our own consultancy and Invc.me (our startup product) was nothing more than a pre-alpha prototype that we used internally. We had no real plan and no real momentum. Things are a lot very different now and, upon reflection, I feel there are there are three key things that we have learnt through Startmate that have changed our approach to building a product.

1. Focus. It’s not impossible to build a startup on the side whilst maintaining a day job but, having tried both, I can attest to the fact that spending 3-4 weeks solidly testing your concept and assumption with real customers is the best way to figure out if you startup has any chance of success. Bootstrapping is a fine way to fund your startup but in the future I know I will always take a few weeks to spend 80% or more of my time validating a concept new concept before I go any further. (more…)

Building Blocks and Changing Business Models

I’ve got a lot of respect for the ideas presented in author and entrepreneur Alexander Osterwalder’s Stanford University series on the business model canvas. As he points out (and as I try to remind my clients), “great products are becoming a commodity. It’s the combination between great products and a great business model that is going to keep you ahead of the competition in the coming decade.” (more…)

What Went Wrong With Kodak, RIM and Xerox?

Innovation is about more than making giant, well-publicized leaps. It’s about striving for continuous incremental innovation to improve your offerings and keep on top of changes in your industry – and plenty of entrepreneurs could be doing this better.

Particularly in Canada, entrepreneurs have a problem making innovation pay. Research at Canadian universities tripled from $1.7 billion in 1999 to $5.5 billion in 2008, but revenues earned from their patents were significantly lower than what was earned by their European and American counterparts. The developers of these technologies are having trouble bringing their solution to market.

Established corporations can also face an innovation gap that is only partly explained by complacency. Some examples include Kodak, RIM and Xerox:

- Kodak had built up a multi-billion dollar company with a global brand years before digital photography came on to the market, sticking with film. It’s Japanese competitors saw where the market was headed. Today, Kodak has filed for bankruptcy.

- RIM’s meteoric rise was stunning, seeing the mobile business platform pioneer go from nothing to $10 billion in revenues after just 15 years. But Apple and Google-based smartphones were nipping at its heels. Despite its lead, RIM failed to match the browser experience or touchscreen capabilities of its competitors and its share price has dwindled to a small fraction of what it was.

- Xerox PARC was he innovation heart for its company, developing a mouse and user interface integration that was revolutionary for its time. Xerox didn’t know what they had, but Steve Jobs of Apple did, running with the innovation in Apple’s own Macintosh product. At this point, it’s impossible to say precisely how much revenue Xerox has given up over the years from this blunder, but it’s safe to say that it was a lot.

Innovating is hard, but recognizing a truly innovative technology for what it is and selling it is a common entrepreneurial challenge. Sometimes, the problem is packaging; entrepreneurs don’t know how to sell what they’ve got. Other entrepreneurs struggle with putting together a business plan around a technology. As we’ve seen, it’s not a problem confined to new business startups; but ideally, entrepreneurs who understand how to capitalize on innovation when starting out can instill that vision in their team as the company grows.

Value Is Different from Price

The North American consumer is addicted to low prices when it comes to plenty of kinds of consumer goods, but companies are wise to heed Guy Kawasaki’s strategic advice: price isn’t everything – and value is different from price.

Writing recently on what he had learned from Steve Jobs, Kawasaki wrote that “Price is not all that matters-what is important, at least to some people, is value. And value takes into account training, support and the intrinsic joy of using the best tool that’s made. It’s pretty safe to say that no one buys Apple products because of their low price.

Apple is far from the only company that has profited by providing value for its customers rather than a single-minded focus on the price tag.

Nobody buys Prius cars because they’re cheap – even with government subsidies, these eco-friendly cars that are tapping into a style-conscious and green-minded consumer are not inexpensive. And think about how much people are willing to pay for Hallmark cards, simple paper products, that can go for $5 or $6 each. Cost-conscious buyers could pick up a whole box of cards at a dollar store for the same price, or even send a message for free with an eCard, but Hallmark’s well-written passages keep drawing people back for more.

What is the value that you are providing for your target consumer? The question will keep popping up when:

- putting together your business plan

- hiring employees – how will your people help create the value you want to offer? Specialized skills that your competitors don’t have? Customer service?

- understanding your company’s strengths and weaknesses. How does the value you help cover over the gaps?

- presenting to investors. Does your PDF presentation talk about the value you’re offering? What pain point are you helping your customers with?

You can’t entirely neglect price. It’s an important part of your overall business plan. But as Kawasaki would point out, taking part in a race to the bottom in terms of pricing hasn’t helped virtually every Apple competitor overcome the giant’s value proposition. While they’re struggling to achieve profit margins of 5 to 8 percent, Apple’s profit margin is closer to 30 percent – and that’s the value of focusing on value.

Browse Our Blog

- Angel Investors

- Articles

- Business Strategy Tips

- Company Valuation

- Crowdfunding

- Due Diligence

- Entrepreneur tips

- Financial Forecasting

- Financial Modeling Tips

- Going Public IPO

- Government grant business

- High Tech Startup News

- Invest in a business

- Market Research Tips

- Raising Investment Capital

- Raising Venture Capital

- Startup entrepreneur tips

- Vancouver business news

- Video

News & Links