Business Strategy Tips

The Shareholders Agreement

An important part of launching a company is deciding who owns what. When you have multiple owners or when giving out shares to employees, you need to have a shareholder agreement in place.

An important part of launching a company is deciding who owns what. When you have multiple owners or when giving out shares to employees, you need to have a shareholder agreement in place.

This is not as well understood among entrepreneurs as you might hope. I have two clients who recently came to me to look at their proposed share structure because they had an inkling something was off. They were right. The share structure included non-voting shares – that’s a non-starter when it comes to raising money. After all, who is going to buy non-voting shares in a company?

The basics of a shareholder agreement and corporate governance

For those who may not be entirely sure what a shareholder agreement is, let’s go over some basics. The shareholder agreement sets basic rules about how the company is governed. For instance:

- Who sits on the board?

- How are directors selected?

- When can shareholders sell their shares?

- Can shareholders be forced to sell their shares?

- Who has the authority to make certain kinds of major decisions for the company, such as changing the firm’s strategic direction?

The shareholders agreement is a vital document for a private company. After a company goes public, that company will be governed by securities regulations.

Crowdsourcing Funding for Startups

A self-publisher of a web-comic asked for $57,000 on Kickstarter to reprint a series of comic strips and raised ten times as much from more than 7,000 backers – with two weeks to go before the funding drive ended. Meanwhile, a new fashion company took in over $64,000 from nearly 800 funders to launch their new line of multi-functional fabrics – tripling the amount they initially asked for. Clearly, the age of crowdsourced funding has arrived; it’s time Canadian entrepreneurs started examining the possibilities. Actually, they are.

Crowdfunding for new companies and established ventures

Crowdfunding, otherwise known as crowdsourcing, as an alternative source for funding companies is getting more attention these days, since the US Senate has got on board in November with the “Entrepreneur Access to Capital Act”.

According to Forbes Magazine, the legislation allows companies to bypass dated regulations to take advantage of the flourishing online fundraising economy. Specifically:

The bill provides a crowd funding exemption from Securities and Exchange Commission registration of securities offerings, with certain limitations: (more…)

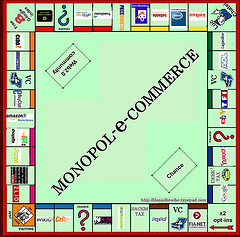

eCommerce for Business Hits Stride

The e-commerce based revenue model helped businesses score record profits over the holiday season. Clearly, this is one revenue stream that entrepreneurs can’t afford to ignore. That said, startup executives need to think clearly about how this revenue model will work in conjunction with the rest of their business plan in order to entice investors.

- (Download our E-Commerce Based Revenue Financial Model. Automatically generate balance sheets and cash flow statements.)

The e-Commerce Revenue Model Opportunity

The numbers for eCommerce shopping over the holidays were staggering even before Boxing Day, according to Network World:

During the one-week period ended Dec. 18, online retail shoppers spent a record $6.3 billion. On four days of that week, the single-day e-commerce tally surpassed $1 billion dollars, according to web watcher comScore.

So far this season, consumers have spent nearly $32 billion online, which is a 15 percent increase compared to the corresponding days of last year’s November-December holiday season. The volume of sales is expected to slow as the holidays draw near and shoppers head for the malls.

For established brick-and-mortar companies, the e-Store has become an essential revenue source; for companies like Amazon and Apple (iTunes store), the online shopping cart is the most important way they make money. And during the holidays, there is an added benefit; since most entrepreneurs actually enjoy taking time off to spend with their families, letting e-Stores handle customers has obvious advantages. The revenue keeps rolling in even as you’re unwrapping gifts in your living room. (more…)

Comments on How to Create Serial Entrepreneurs

I asked for comments on my last email concerning “how to create serial entrepreneurs and had some terrific insights provided by those who read the article. If you recall I wrote that there was no lack of entrepreneurial spirit north of the USA, but in some ways, Canada’s business environment doesn’t provide the best conditions for entrepreneurs to succeed. We provided some suggestions, like better-focused education and mentorship programs, as well as making it easier for entrepreneurs who do fail to fail fast but fail cheaply, so they can dust themselves off and get back at it or move on and work for someone else.

Some Comments on How To Create a Supportive Entrepreneur Landscape

Here are some of the reactions to our question about how to provide a more supportive environment for entrepreneurs:

Steven Jones, Vice President at Pulse Energy says the best way to encourage entrepreneurship is to help them overcome a communications gap and make an essential connection:

“It appears that there is a very large and pervasive communication gap between problem solvers (entrepreneurs) and problem sufferers (potential customers.)

The result is an abundance of entrepreneurs focused exclusively on technology and business problems. This is because entrepreneurs often come from a background of engineering or business education and that’s all they know about. This means that there is extreme competition to solve the valuable problems in these limited domains. Even worse, many of these problem solvers end up resorting to solving weak or unimportant problems (how many mobile phone games does the world really need?) (more…)

Is Your Business Fundable?

You are an entrepreneur with big ideas about your business, but you need capital. While working to raise funding, always pay attention to the investor’s perspective. Ask yourself: “will investors look at your company as a vehicle to make their targeted return on investment (ROI)?

- (Check out our downloadable products helping you develop strategies for attracting investment and different types of capital)

Here are some important factors to consider. Investors need to believe there is a high probability that further funding will be at a higher price per share than what they initially paid, and that the current valuation is realistic. This is significant so as to increase the chances of a higher multiple (return multiplier) being later made on their initial investment. Finally, investors want to be sure that the exit possibilities or liquidity event is plausible and sensible, should the company be successful in executing its plans. This is when they will get their money back out of the investment in your company.

How to Show ROI to Investors for Your Company

Pay special attention to these key drivers of ROI:

- large promising market opportunity (e.g., scalable business in a market over a billion dollars)

- capable and experienced management team (e.g., domain expertise and experience)

- a differentiated product offering (e.g., IP) and

- risk mitigation plans (e.g., market validation) in creating value

A recent New Ventures BC seminar focused on getting funding also had some excellent advice for entrepreneurs getting their feet wet in the fundraising process. Some highlights from this live-blogged presentation of Tanner Philp of Lions Capital on how to approach financing:

For the people who have a sales and marketing background, it is the same kind of blocking and tackling process for getting investors. You need to have a strategy for funding your company and for what objective you are funding.

A lot of entrepreneurs don’t think about the financing strategy when they’re just starting out, but it needs to be considered before a launch.

How long does the process take? That depends on your strategy:

You should be raising funds towards a series of milestones. The more you achieve those milestones, the easier it will be to raise further funding and take it to the next level.

People chronically underestimate the time it takes to raise the capital. In the case of a high net worth friend, you may be able to close a deal over the first bottle of wine — but in most cases, it is far more challenging. Often, starting out you can be looking at four to nine months… and closer to nine than four.

Learn more about strategies for attracting investment and different types of capital

How to Tap the Investor for Capital, Advice and More

Even entrepreneurs who know how to raise capital may still not be taking full advantage of the relationships they’ve built with investors. Particularly with angel investors and venture capitalists, there’s an expectation, if not an obligation, to make use of their expert advice to help drive your business to success. Your backers may have crucial expertise as valuable as the financial investment they make in your enterprise.

Even entrepreneurs who know how to raise capital may still not be taking full advantage of the relationships they’ve built with investors. Particularly with angel investors and venture capitalists, there’s an expectation, if not an obligation, to make use of their expert advice to help drive your business to success. Your backers may have crucial expertise as valuable as the financial investment they make in your enterprise.

Types of Angel Investor Expertise

Here are some examples:

Mentoring

Entrepreneurs or CEOs can gain much by asking experienced investors to act as mentors. They can provide great insights into finance, among other things. In early-stage companies, some lead investors or VC firms might provide the assistance of entrepreneur-in-residence, an experienced person who acts as a mentor.

Hiring

As we briefly mentioned above, experienced investors have wide-ranging industry contacts and are better than any executive search agency, not to mention much faster. You can be fairly confident that they can help you with hiring for almost all senior positions, either in engineering or management.

Strategic Alliances

Experienced investors can offer great ideas with regard to forging strategic alliances in the market and also provide you access to the right people in case you do not have your own network of contacts. They can help in providing sales leads, too.

Suitors

You can be assured that experienced investors have considered potential acquisition, or merger, partners before you have. Chances are they even have analyzed the prospective companies for the “best fit” with your company’s offerings. You should seek their assistance in forming a liquidity event strategy as this, in many cases, has been how your investors have made their money. They will also be interested in supporting you as they are interested in getting their money out one day when the time is ripe.

Entrepreneurs have to be on the lookout for a range of accelerators for their business, not just capital although raising capital is critical. Mentors, strategic alliances and other opportunities can come up at any stage and should be leveraged. Make sure you’ve got a strategy in place to take advantage of them.

Netflix and the Success of the Subscription-Based Revenue

What do software, magazines, certain types of television shows, phone service and fitness centers all have in common? All of these businesses operate according to a subscription-based revenue financial model.

What do software, magazines, certain types of television shows, phone service and fitness centers all have in common? All of these businesses operate according to a subscription-based revenue financial model.

As Netflix has demonstrated, this model that has been around for ages, when coupled with technological innovation, can provide an edge to knock established industry giants off their feet.

The story of Netflix vs. Blockbuster is already being used in business schools as a case study in competitive business models. Blockbuster, as we know, has already filed for bankruptcy. Netflix, despite some serious and well-publicized setbacks in 2011 due to conflict with content providers, is still very much alive and kicking (and ultimately, those content providers will likely have to come around).

The Gourmet Retailer provides a synopsis of the trend in Has Business Really Changed?:

The neighborhood video rental store is on its last legs because guess what, streaming video from Netflix and others is rampaging into America’s living room. Netflix vs. Blockbuster was no contest. Blockbuster opened 4,000 stores in two decades. Netflix sales were up 43,101 percent from 1999. That’s not a mistake, sales were up 43,101 percent and Blockbuster filed for bankruptcy in 2010. And music stores keep closing. iTunes made its debut in 2003 with devastating effects on music retailers. Tower Records went out of business in 2004, and Musicland folded in 2006. Songs sold on iTunes: up 1,169,900 percent from 2003. The trend is clear.

It’s not that brick-and-mortar stores are on the way out. Clearly, some types of retailers are here to stay for the foreseeable future. People still like to shop for their own groceries in supermarkets. Plenty of customers still like to try on clothes at the Gap. Electronics retailers like Best Buy often have sophisticated e-shopping websites with discounts on their in-store products, but they still have enough walk-in traffic to justify giant big-box stores.

That said, a subscription model can offer competitive advantage in a number of ways. Importantly, revenue is more consistent. Yes, people do change or cancel their subscriptions, but those decisions are not made as often as purchasing decisions. Companies can continue to earn revenue for months or even years before a customer finally gets around to canceling. Most of us who got fitness club memberships and stopped showing at the gym can relate to this situation from the other side of the ledger.

Financial Models with Sensitivity Analysis: Subscription Revenue

Perhaps you’re already considering developing a subscription revenue model business. Success for these types of companies in particular depends on accurate financial projections. Our downloadable templates include revenue forecasting sheets, cost assumption sheets that then automatically generate financial statements such as Income, Balance Sheets and Cash Flow statements. These will help you understand how your business “pencils out”..

DOWNLOAD Financial Models with Sensitivity Analysis: Subscription Revenue

What is Investment Capital and How Do I Get It?

What is venture capital, exactly? How was Christopher Columbus’ discovery of the New World like a spectacularly successful business startup? And how can your company combine Strategy, Structure, Substance and Sizzle to persuade investors to fund your company to achieve success? Lyn Blanchard of Your Capital Edge answers these questions and more in a friendly chat with a business colleague.

Listen to this conversation about how to raise capital for your business from investors

Browse Our Blog

- Angel Investors

- Articles

- Business Strategy Tips

- Company Valuation

- Crowdfunding

- Due Diligence

- Entrepreneur tips

- Financial Forecasting

- Financial Modeling Tips

- Going Public IPO

- Government grant business

- High Tech Startup News

- Invest in a business

- Market Research Tips

- Raising Investment Capital

- Raising Venture Capital

- Startup entrepreneur tips

- Vancouver business news

- Video

News & Links